Planning for retirement may be quite daunting, specifically with the myriad of financial options to be had and future uncertainties. Staying informed approximately market traits and adjusting your method therefore can contribute to a stable retirement plan. But, this could now not be an easy feat.

That said, services offering non-public wealth management in Sydney can successfully alleviate the pressure and uncertainty related to retirement planning. These offerings provide tailor-made techniques to help people stabilize their economic future and experience retirement with lots of peace of mind. So, discover how these management services can assist with retirement planning.

Personalized Retirement Strategies

One of the number one advantages of Sydney’s non-public wealth management services is their customized approach to retirement planning. Rather than using everyday answers, these services don’t forget every character’s specific monetary state of affairs, goals, and risk tolerance to broaden a customized approach. Wealth managers can lay out a comprehensive groundwork that addresses customers’ unique desires and aspirations by analyzing factors including earnings, costs, belongings, and liabilities. Whether through varied investment portfolios, tax-green financial savings plans, or coverage answers, they ensure that every component of a patron’s economic lifestyle is optimized for retirement.

Expert Guidance and Advice

Navigating the complexities of making plans may be overwhelming, however, these services provide expert guidance with each step of the manner. Clients have access to experienced monetary advisors in Sydney who can offer valuable insights and recommendations primarily based on their expansive understanding of the market and contemporary monetary developments. These advisors paint quite carefully with clients to recognize their economic goals and concerns, providing personalized pointers and techniques to assist them in achieving long-term financial safety. From asset allocation to estate mapping, those experts assist customers make a lot of knowledgeable selections that align with their desires.

Comprehensive Wealth Management

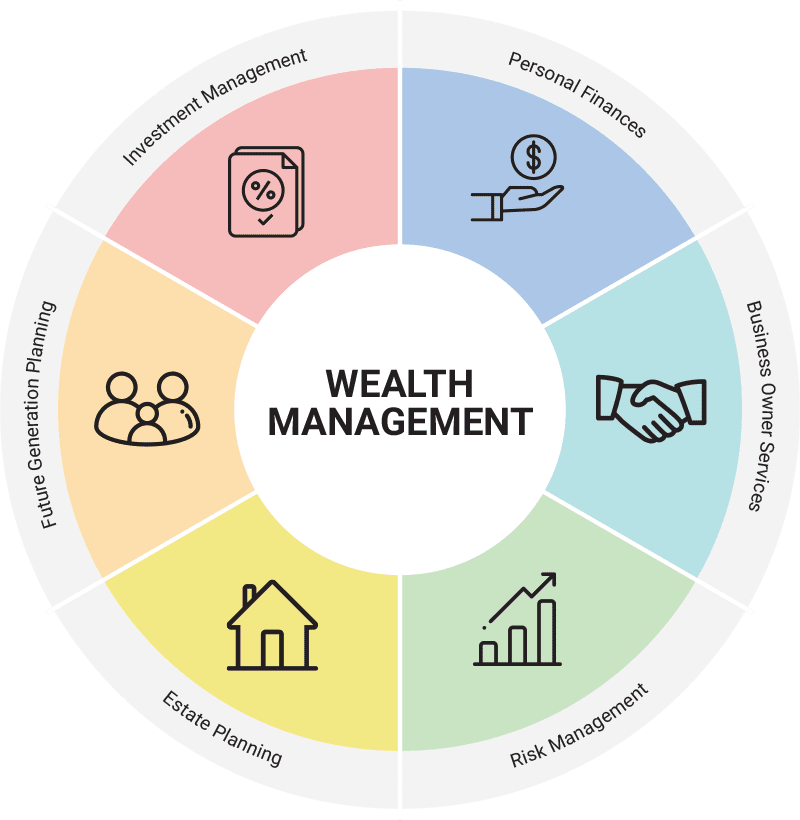

This type of making plans is just one piece of the puzzle concerning managing finances. These management services in Sydney offer comprehensive solutions that embody all factors of control, inclusive of investment, property mapping, tax optimization, and hazard management. By taking a much greater holistic method to monetary planning, these services make sure that clients are nicely located to obtain their lengthy-term economic targets, along with a comfortable retirement. Professionals paint pretty carefully with customers to expand a complete economic basis that addresses their short-term wishes and long-term goals. They recollect risk tolerance, time horizon, and liquidity desires to create an assorted investment portfolio that maximizes returns whilst minimizing threats.

Access to Exclusive Investment Opportunities

One of the benefits of working with those services is get right of entry to to distinct investment opportunities that might not be available to character buyers. These offerings often have endless get entry to a huge range of investment liaisons, inclusive of personal equity, hedge budget, and opportunity investments, that may probably decorate returns and diversify portfolios. By leveraging their network and knowledge, wealth experts help clients capitalize on moneymaking funding possibilities while managing change efficiently. Additionally, they behavior thorough due diligence on investment possibilities to make certain they align with the client’s economic dreams and threat tolerance.

Ongoing Monitoring and Adjustments

Retirement-making plans are a system that calls for the right monitoring and adjustments. Private wealth management offerings in Sydney provide normal reviews of customers’ economic plans to make sure they stay on the right track to satisfy their destiny desires. Wealth managers display investment overall performance, monetary situations, and modifications in clients’ situations to become aware of any important modifications to the financial plan. Whether it’s adjusting investment allocations, rebalancing portfolios, or updating estate plans, these services adapt to modifications within the marketplace and clients’ lives to ensure the most beneficial economic results. By supplying ongoing assistance and steerage, wealth managers assist customers traverse the complexities of retirement planning with self-assurance and peace of mind.

Services supplying non-public wealth management in Sydney are pretty crucial in helping people navigate the complexities of retirement-making plans. By entrusting their monetary destiny to skilled professionals, individuals can embark on their retirement adventure with self-belief and peace of thoughts.

Read More: https://chillwithkira.com/